A Beginner’s Guide To Property Investment

A Beginner’s Guide to Property Investment with Alan Edwards

A Beginner’s Guide to Property Investment with Alan Edwards

Understanding Property Investment: A Beginner’s Overview

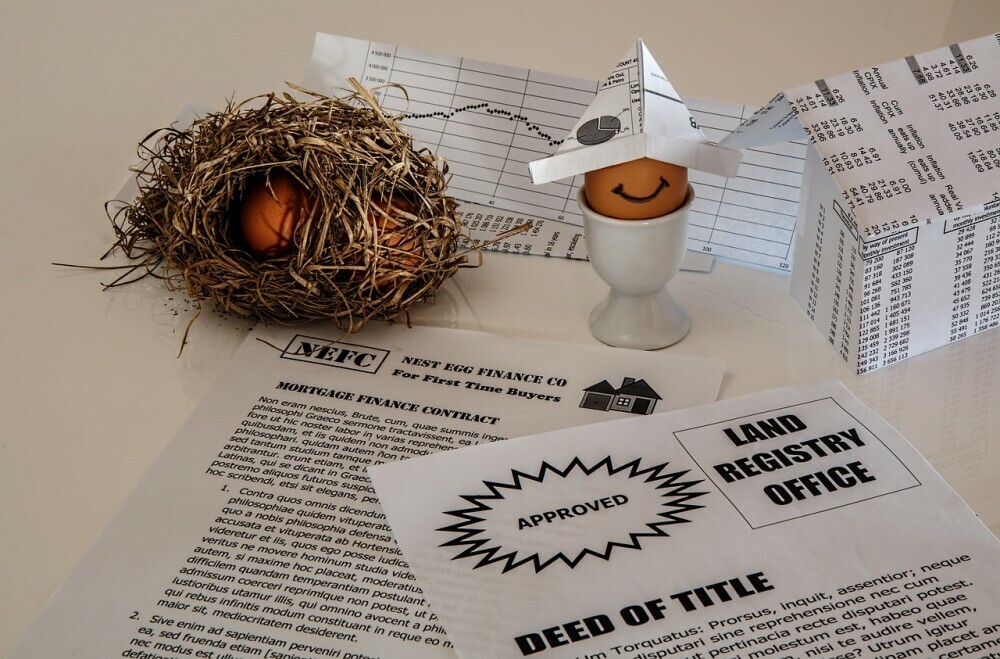

Welcome to the world of property investment! If you’re considering adding real estate to your investment portfolio, you’re in good company. Property investment can offer substantial returns, but it’s essential to approach it with knowledge and strategy.

Our guide will walk you through the basics of property investment, providing valuable insights from renowned expert Alan Edwards. With his extensive experience in the industry, Alan offers invaluable advice to help you make informed decisions.

What is Property Investment? Property investment involves acquiring real estate with the intention of generating income or profit. This can be through rental income, property appreciation, or a combination of both.

Types of Property Investment

- Residential: Investing in properties intended for residential use (houses, apartments, condos)

- Commercial: Investing in properties used for business purposes (offices, retail spaces, industrial buildings)

- Industrial: Investing in properties for industrial use (warehouses, factories, distribution centers)

- Land: Investing in undeveloped land with potential for future development

Benefits of Property Investment

- Potential for high returns

- Diversification of investment portfolio

- Tax advantages

- Hedge against inflation

- Generating passive income

Risks of Property Investment

- Economic downturns can impact property values

- Property management challenges

- Vacancy periods

- Unexpected maintenance costs

Common Myths and Misconceptions

- You need a large amount of capital to start

- Property investment is a guaranteed path to wealth

- Property values always increase

The Initial Steps: Preparing for Your Property Investment Journey

Before diving into the world of property investment, it’s crucial to lay a solid foundation.

Assess Your Financial Situation

- Determine your investment budget

- Evaluate your risk tolerance

- Consider your financial goals

Selecting the Ideal Property Type

- Identify your investment objectives (cash flow, capital appreciation, or both)

- Research different property types and their potential returns

- Consider your geographic preferences and market conditions

Market Analysis

- Understand local market trends and conditions

- Analyze rental demand and vacancy rates

- Identify areas with high potential for property appreciation

Building Your Team

- Find a reliable real estate agent

- Secure a mortgage lender

- Consider hiring a property manager

Making Your First Investment: Practical Tips and Strategies

Identifying Investment Properties

- Use online tools and platforms

- Network with other investors

- Build relationships with real estate agents

Due Diligence

- Conduct thorough property inspections

- Review property history and financials

- Analyze rental income potential

Financing Your Investment

- Explore mortgage options

- Consider private lenders or investors

- Understand interest rates and terms

Negotiating and Closing the Deal

- Develop strong negotiation skills

- Work with a knowledgeable real estate attorney

- Prepare for closing costs and transfer taxes

Legal and Tax Considerations

- Consult with a tax advisor

- Understand property tax implications

- Comply with landlord-tenant laws

Maximizing Returns and Managing Your Investment

Increasing Property Value

- Property renovations and improvements

- Landscaping and exterior upgrades

- Energy-efficient upgrades

Effective Property Management

- Screen tenants carefully

- Maintain regular property inspections

- Address maintenance issues promptly

Rental and Resale Opportunities

- Develop a rental strategy

- Evaluate market conditions for potential resale

- Consider property refinancing options

Reinvesting Profits

- Create a reinvestment plan

- Explore opportunities for property expansion

- Diversify your investment portfolio

Staying Updated

- Attend industry conferences and seminars

- Follow real estate market trends

- Continuously educate yourself about investment strategies

Remember, property investment is a long-term commitment. By following these guidelines and seeking expert advice from professionals like Alan Edwards, you can increase your chances of success.

Would you like to focus on a specific aspect of property investment, such as finding the right property or managing rental properties?

If you would like to discuss any aspects of A Beginners Guide To Property Investment With Alan Edwards do not hesitate to Call Alan on 07539141257 or 03332241257, or +447539141257 or +443332241257, you can schedule a call with Alan on https://calendly .com/alanje or drop an email to alan@alpusgroup.com.